Introduction To Quick Cash Loans

Quick Cash Loans & Lending Platforms in Nigeria – Have you ever considered how to get quick loans in Nigeria? There are instances when we need money fast to solve a necessity, such as a debt, pay payments, or close a contract. During such instances, we want rapid cash without having to go through the cumbersome process that most banks or lending schemes impose before granting loans.

Sometimes the money you need isn’t worth the hardship, or you just want to avoid shame.

To put the above statement into context, imagine heading into a commercial bank in the morning asking for a ₦10,000 loan. Aren’t you a bit embarrassed? I comprehend.

I could be feeling the same way. Add to that the inconvenience of having to wait in line, as is common in many Nigerian commercial banks. Worse yet!

The instances described above, as well as others, required and increased the need for rapid loans and lending platforms in Nigeria. Many such fast loans and lending platforms have sprung up in Nigeria in recent years, but which of these platforms are the best and top-rated?

Ultimate List of Quick Cash Loan Companies In Nigeria

1. Sofri

Sofri is powered by Links Microfinance Bank and is exclusively dedicated to meeting your cash obligations. Sofri is fast, adaptable, and dependable. Sofri offers loan amounts of up to ₦5 Million depending on the type of loan.

Sofri Quick Cash: It is an instant, short-term loan designed to take care of those moments where customers need to bridge gaps in finances for a short while. The loan application and disbursement process take place within 5 minutes maximum time, and the repayable term is within 15 days to 180 days. The loan amount is from ₦5,000 to ₦100,000. Sofri offers a 10% interest rate on all quick cash loans. The goal of this loan is to enable Sofri customers to have easy access to finance in times of need.

Requirement

- You will need to download the Sofri mobile app to enjoy this loan

- You will need to create an account on the app and then upgrade your account with zero extra charges to be able to apply for this loan.

2. PayLater Now Carbon

Carbon Previously known as PayLater, this easy lending company provides loans in minutes. It offers short-term loans to assist you to handle acute needs and crises. You may apply and obtain a loan without any documents. To determine loan credit, all you need is your bank verification number (BVN). With this software, you may get up to ₦20 million with interest rates ranging from 5% to 15%.

PAY LATER is a Nigerian quick loan and lending platform based on Android. When you download and install the PAY LATER app from Google Play, you will be charged a 100 naira validation fee when you register.

The more you return your debts on time, the larger your credit limit will be. You must supply proper bank information and a BVN.

The interest rate ranges from 5% to 30%, and the loan term spans from 15 days to 6 months. You may repay loans with your Debit Card, the Quickteller platform, or a direct transfer from your bank account.

Requirements:

- BVN

- Business/home address

- Passport photograph

3. ALAT

ALAT is the country’s first totally digital bank. It is a branch of Wema Bank Nigeria. You do not need to go through the procedure of creating an account in a commercial bank with ALAT, but you may use it as a bank account since you will be granted a Debit Card connected to your ALAT account. ALAT interest rate ranges between 29 – 30%.

4. Fair Money

FairMoney is one of Nigeria’s most popular digital lending platforms, designed to offer fast, convenient, and collateral-free loans to individuals and small businesses. With a strong focus on financial inclusion, FairMoney provides a user-friendly mobile application that allows users to apply for and receive loans anytime, anywhere.

They built a new type of credit-led digital bank: as loans are needed to fund your business or for personal reasons, they offer no collateral to make life easier based on their claim. Since you cannot access those services from traditional banks.

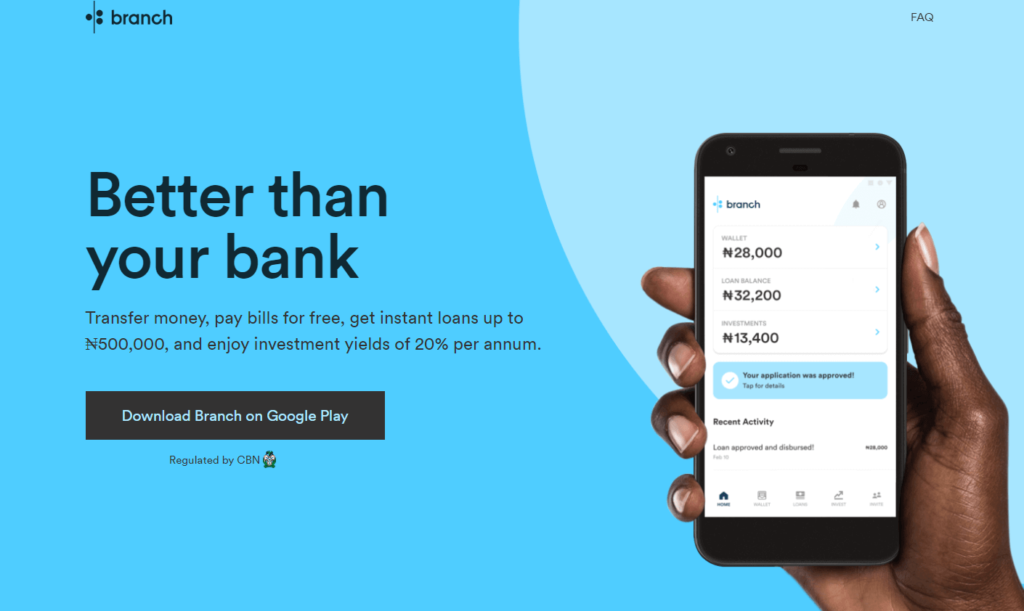

5. Branch

Branch is a straightforward yet effective mobile lending app available in Nigeria and Kenya. Obtaining quick and rapid loans with Branch App is simple and quick. It will assist you in resolving your money problems in real-time.

The branch provides loans ranging from ₦1,500 to ₦150,000.00. The loan periods range from four to sixty-four weeks. Depending on the loan option chosen, interest rates range from 14 percent to 28 percent, with an equal monthly interest rate of 1 percent to 21 percent.

6. SMEDAN

SMEDAN is funded by the Nigerian government, and its mission is to provide business loans to Nigerian-owned small and medium-sized firms (SME) in need of capital. It is intended to support Nigerian entrepreneurs.

7. QUICKCHECK

Install the QuickCheck app on your Android smartphone or go to the QuickCheck website. The interest rate is 1% each day, and the loan term spans from 5 to 30 days.

QuickCheck requires you to provide evidence of income as well as select an employment status. With the QuickCheck app, you can receive loans or buy phone airtime. Please also provide your Facebook account, bank information, and cell phone number.

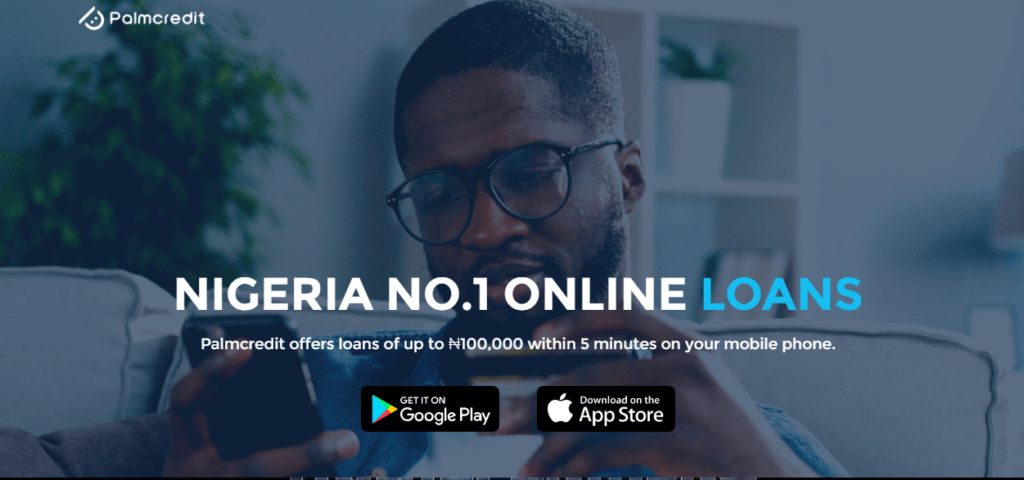

8. Palmcredit (PalmPay)

PalmCredit is a virtual credit card that makes it easy for you to access a loan anytime and anywhere. Palmcredit offers loans of up to ₦100,000 within minutes on your mobile phone.

Palmcredit offers a wide range of the loan products that will satisfy the needs of most customers.Loans range from ₦2,500 to ₦100,000 with loan term durations of 12 – 26 weeks.

Palmcredit is Operated by Newedge Finance Limited, the app is designed to make borrowing simple and hassle-free, empowering Nigerians to meet their financial needs conveniently.

9. ZEDVANCE

ZEDVANCE is a web-based quick lending platform. Simply login and register on the ZEDVANCE website.

The interest rate starts at 7.5 percent, and the loan term goes from 1 month to 12 months. To repay loans, you must use your Debit Card, bank deposit, or checks.

10. C24

C24 Capital is a financial firm that offers retail loans to individuals that want immediate financial assistance. On C24, you just need to present bank information and a few additional papers in person, including a national ID card, employment verification, bank statement, passport photograph, and a direct debit mandate.

11. Okash

Okash is a digital lending platform operated by Opay, designed to provide fast, reliable, and collateral-free loans to Nigerians.

With a focus on convenience, Okash ensures individuals can meet their urgent financial needs without the hassle of traditional banking processes. It is accessible via the Opay app, offering users seamless access to instant credit.

12. Credit Direct

Credit Direct Limited is a non-bank financial institution in Nigeria, specializing in providing personal loans to individuals and small businesses. With a vision to become the preferred innovation-driven financial service partner in Nigeria and beyond,

Credit Direct has established itself as a trusted provider of quick, collateral-free loans. Credit Direct offers personal loans up to ₦5 million with repayment plans extending up to 18 months. These loans are designed to be quick and accessible, requiring no collateral.

13. Renmoney

Renmoney goes even farther, with a maximum lending rate of up to ₦4 million and a mean term of 9 months. It also does not require a guarantor or collateral, albeit you must satisfy certain standards. Furthermore, the amount you can borrow is established following a background check and evaluation of prior loan reports from a credit agency. Their interest rate is between 4% and 4.5 percent.

Requirements

- The minimum age range is between 22 and 59

- A steady source of income with proof of bank statement

- Valid means of identification

- Verification of your standard monthly income

- Report on previous loans from a credit bureau

14. KiaKia

KiaKia is a mobile web app that provides access to personal and small business loans as well as allows savers to lend out cash at agreed interest rates through easy discussions.

KiaKia’s patented credit score and credit risk assessment system uses psychometry, big data, machine learning, and digital forensics to give direct and peer personal and commercial loans to millions of individuals and SMEs that lack credit information.

15. kwikmoney (Mines)

Kwikmoney increases its reach beyond just lending services through smartphone to include USSD loan codes. As a result, it is working in collaboration with mobile network carriers, banks, and other technology firms to make services as accessible as feasible. Furthermore, you may obtain short-term loans up to ₦15,000 at a 15% interest rate. However, their loan term is only 15 days.

16. Rosabon Finance Quick Loan

Rosabon financing is one of the quickest and easiest methods to get a personal loan in Nigeria without collateral.

A loan of ₦70,000 for interest draws a 4-month payback of ₦82,915. This equates to 4 to 6 percent every month.

Some of the prerequisites for obtaining a quick cash loan from Rosabon financing include being in a paid work, being between the ages of 21 and 58, having a salary account, having a pension account or tax ID, having a valid Proof of Identification, and having a current utility bill.

17. Page Financials

Before accepting your loan request, Page Financials takes you through a detailed 6-step procedure. In addition, they charge a daily borrowing rate of 0.5 percent, which adds up to around 15 percent monthly or more if you miss a payment. Furthermore, they provide loans via a debit card preloaded with ₦500,000 (or more, depending on your monthly salary).

Requirements

- Letter of employment

- Valid means of identification

- Utility bill

- Salary account

Money Lender Platform: Top 9 Lowest Interest Loan Rates Companies And Platforms in Nigeria

Many financial loan lending platforms in Nigeria currently provide services to individuals and businesses at all levels. However, not all offer dependable and lucrative services to their clients. The finest lending services offer immediate payment, low yearly interest rates, and a reasonable payback period.

Most significantly, they are secure and offer rapid loan approval.

In no particular order, here are some of the top rapid loan applications in Nigeria that offer financial lending services to individuals, established businesses, and, most crucially, the often-overlooked small-medium enterprises SMEs.

Note: This category is based on the maximum interest rate per month on any loan type

| S/N | Platform Name | Loan Rate & Repayment Interest | Loan Range & Duration |

| 2 | Okash | Okash offers Interest rates: With a minimum of 0.1% up to 1% | Loan Amount: from NGN 3,000 to NGN 500,000 Tenure: OKash requires repayment from 91 days to 365 days |

| 3 | Lidya | Lidya offers an interest rate of 3.5% per month. | The loan amount at Lidya ranges from ₦150,000 and above |

| 4 | Sofri | Sofri offers a minimum monthly interest rate between 2.9% to 4% which is dependent on the loan type | Loans range from ₦5000 to ₦5 Million with tenors from 30 days – to 18 months with the exception of rent loans with a tenor of 24 months |

| 5 | Palm Credit | Their interest rate is between 14% to 24%, and Equivalent Monthly interest is 4%~4.7% The loan term is between 14 days to 180 days. | Palm credit charges a monthly interest rate of 4% if you pick a 6-month loan and borrow ₦100,000. Borrow NGN interest rate: 24%, APR: 48% ₦24,000 in repayments over 180 days. The total amount paid is ₦124,000. |

| 6 | Renmoney | Monthly interest rates range from 2.76% – to 9.33% repayable in 3 -24 months. | Offers personal or micro-business loans ranging from ₦50,000 to ₦6 million |

| 7 | Carbon | Interest ranges from 1.75% – to 30%, with an equivalent monthly interest rate of 1 – 21%. | Users can receive up to ₦20 million with an interest rate ranging from 5-15%, depending on the repayment time frame and the amount of loan received |

| 8 | Branch | Tenure is 62 days to 1 year. Monthly interest rates are from 1.7% to 22% | Loan Amounts variers from ₦1,000 to ₦200,000 for their microloans |

| 9 | Fair Money | Fair money offers tenors of 61 days to 18 months at monthly interest rates that range from 2.5% to 30% | Loan Amount: ₦1,500 to ₦1,000,000 Example: The app loan application form is very easy. You can borrow up to ₦500,000 using FairMoney App and a maximum repayment period of 1 year and 6 months (18 months) at an interest of 10% per month |

| Quick Check | The Interest rates vary from 2% to 30%, with an equal monthly interest rate of 1% to 21%. (APRs ranging from 30% to 260%) | Loans range from ₦1,500 to ₦500,000 with terms from 91 days – to 1 year. |

Conclusion: Final verdict on Quick Cash Loans Platforms in Nigeria

Loan lenders in Nigeria are not just about interest rates; rather, it is about patronizing the loan lender that best meets the needs of the borrower. Whether it is for a rent loan, auto loan (car loan), a salary loan, a business loan, or a quick cash or school fees loan. Whatever the pressing necessity may be. To prevent the hassle of harassment from some loan providers, make your choice depending on the purpose of the loan and the length of the loan payback period. Sofri is all about offering you peace of mind while repaying back your loan. If you wish to get started with us, download our mobile app to enjoy the Sofri loan benefits.